Debtor input

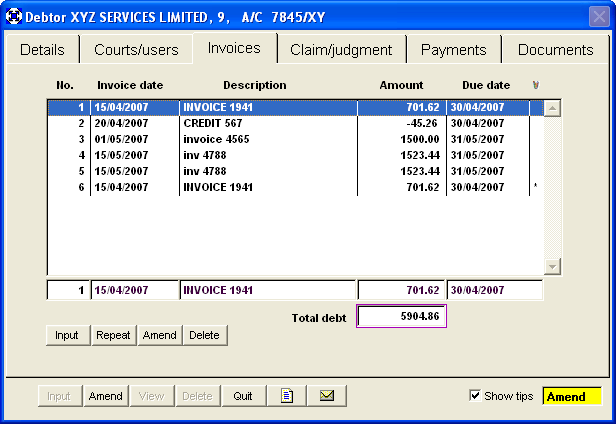

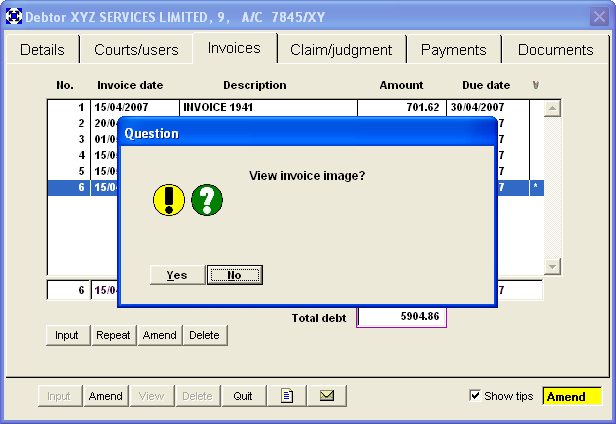

This screen follows on directly after debtor input.

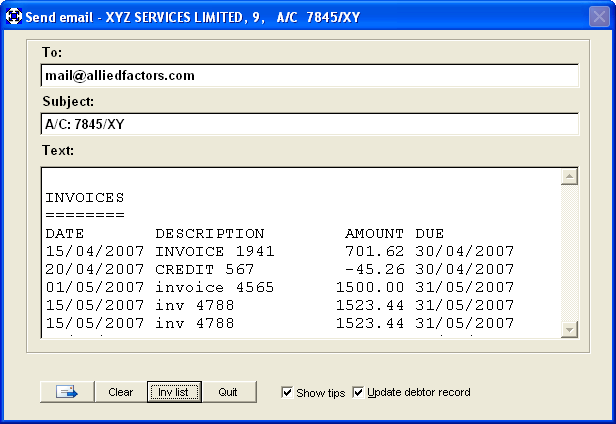

The debtor name and number is inserted automatically and you are permitted to insert 12 lines of debt detail.

Where there are more than 12 lines of debt, try to group the invoices into monthly accounts. On a nett monthly

account basis all invoices in any given month fall due for payment on the same day. Invoice values should include VAT.

Round sum payments which have not been allocated can be input as follows:

DATE DESCRIPTION AMOUNT DUE

15/01/2007 Payment (£500.00) 15/01/2007

The date of the payment is deemed to be its due date.

Alternatively, deduct the payment(s) off the oldest invoices first. This will probably result in one part paid invoice:

DATE DESCRIPTION AMOUNT DUE

15/01/2007 INVOICE 1234 (PART) £401.23 15/02/2007

The due date for payment is important because it is the date used for the calculation of interest at 8% when

a claim is issued. See INTEREST

Invoices entered in ERROR may be deleted later which will reduce the total due on DEBTOR SCREEN 1.

This screen follows on directly after debtor input.

The debtor name and number is inserted automatically and you are permitted to insert 12 lines of debt detail.

Where there are more than 12 lines of debt, try to group the invoices into monthly accounts. On a nett monthly

account basis all invoices in any given month fall due for payment on the same day. Invoice values should include VAT.

Round sum payments which have not been allocated can be input as follows:

DATE DESCRIPTION AMOUNT DUE

15/01/2007 Payment (£500.00) 15/01/2007

The date of the payment is deemed to be its due date.

Alternatively, deduct the payment(s) off the oldest invoices first. This will probably result in one part paid invoice:

DATE DESCRIPTION AMOUNT DUE

15/01/2007 INVOICE 1234 (PART) £401.23 15/02/2007

The due date for payment is important because it is the date used for the calculation of interest at 8% when

a claim is issued. See INTEREST

Invoices entered in ERROR may be deleted later which will reduce the total due on DEBTOR SCREEN 1.

ERROR MESSAGES

LINE CAPACITY

You may not enter more than 12 lines

ABORT

If, during the input process, you abort the first line of invoice detail, a default invoice line is stored with a reference '99999'.

This may of course be superceded later with the correct invoices.

LINE DELETIONS

You may delete any line from those displayed unless there is only ONE line.

ONE line must remain as the breakdown of the debt due.

[Maintenance…Debtor…Input]

[Maintenance…Debtor…Input]

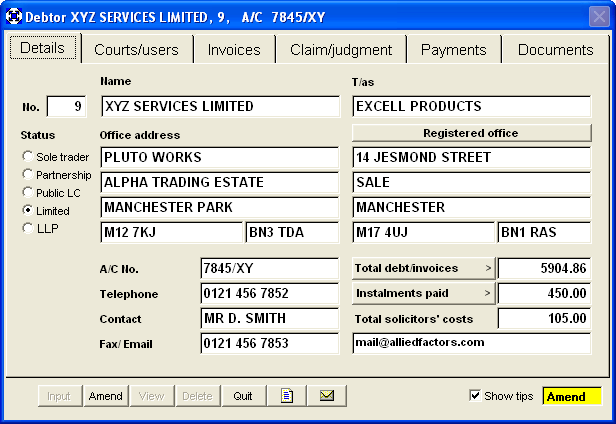

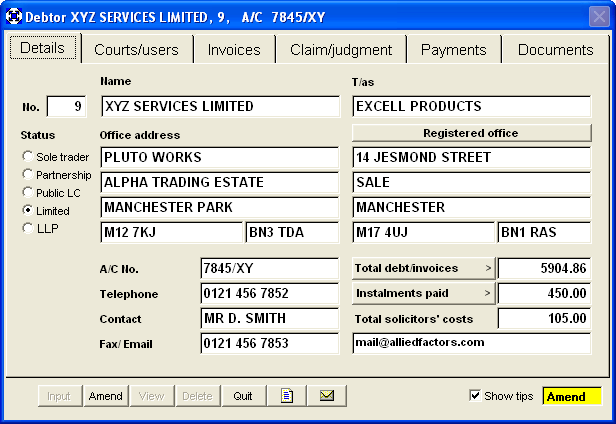

STATUS

This radio button group is used to decide where the claim will be sent to. Companies will be served

at their registered office.

1 = Sole Trader/Individual

2 = Partnership

3 = Public Limited Company

4 = Private Limited Company

5 = LLP (Limited Liability Partnership)

OFFICE ADDRESS

Insert the normal address for correspondence. Insert telephone and fax number.

TOTAL DEBT

Insert the total debt due including VAT. If the total of the invoices entered later differs from this

figure, it will be updated.

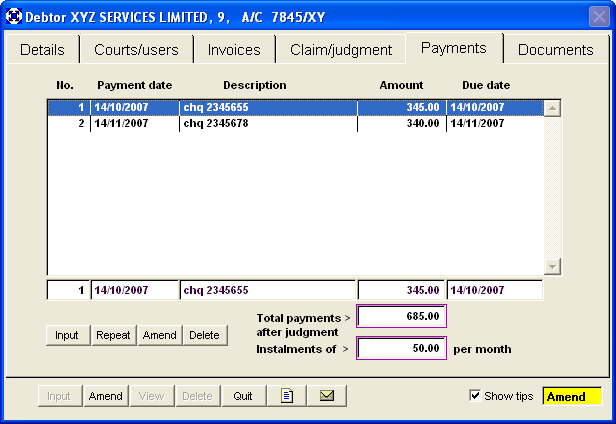

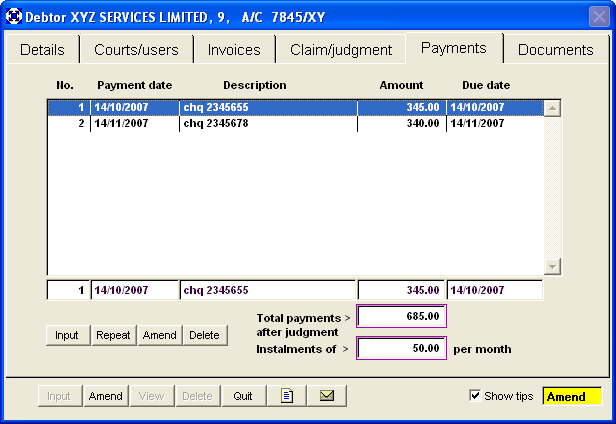

INSTALMENTS

Insert the total of payments received after proceedings have commenced. You are required to keep a

detailed record and notify the Court accordingly.

REGISTERED OFFICE

This is the legal address for service of legal documents on a limited company or PLC.

NOTES

Insert notes in this scrollable window. The system inserts events here Example: Claim issued 21/09/2006.

Notes have unlimited capacity.

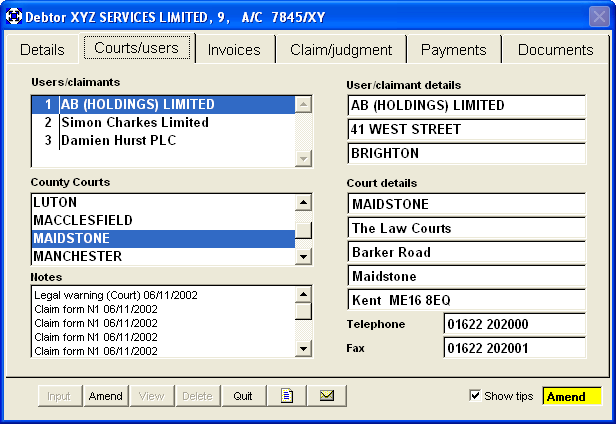

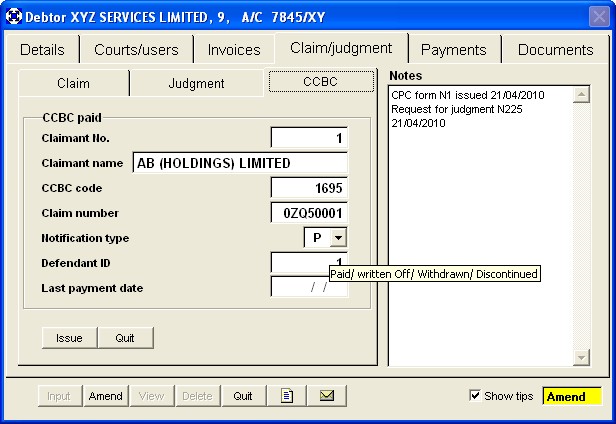

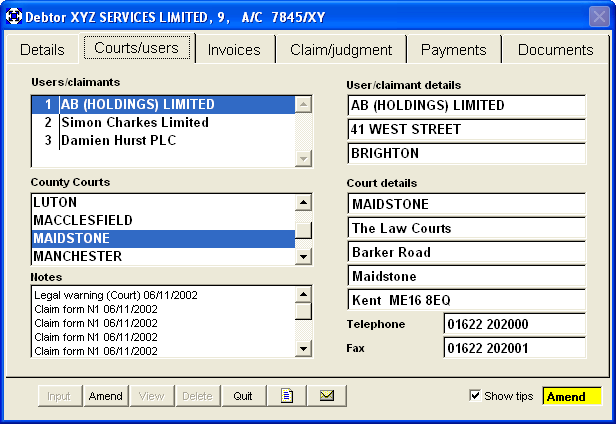

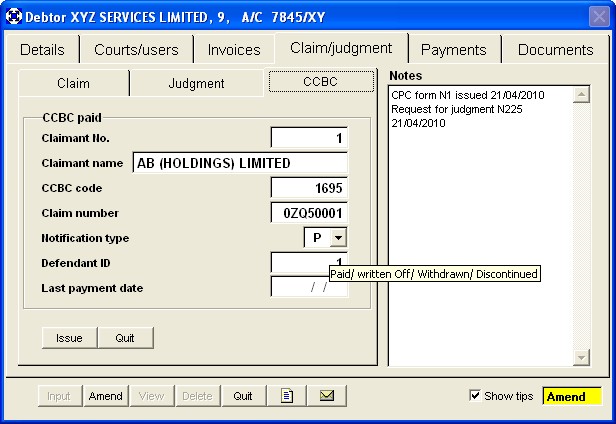

Courts/users

This page is used to record the user, debtor’s County Court and notes.

Fields are updated automatically as documents are issued, but can be amended if required.

Refer to the simplified court flowchart.

USER

Click from the scrollable list the user who will be the Claimant or creditor. The default is the first

user in the list.

Each debtor must be identified with one of the possible USERS (CLAIMANTS) on the system. These details

will be required to complete court documentation.

Each additional Court fee is added to the judgment thereby increasing the amount owed by the defendant.

You must notify the court of any payments received and deduct them to determine a revised judgment value.

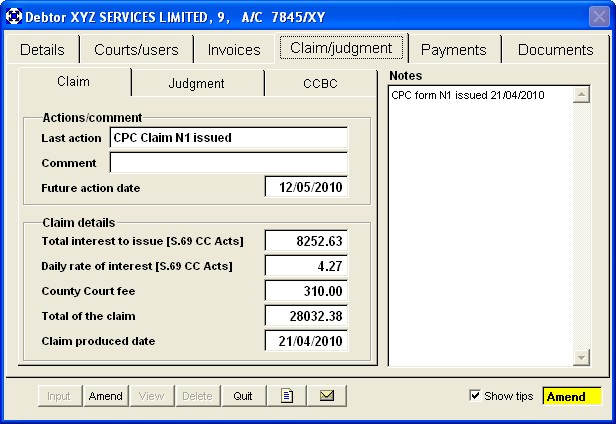

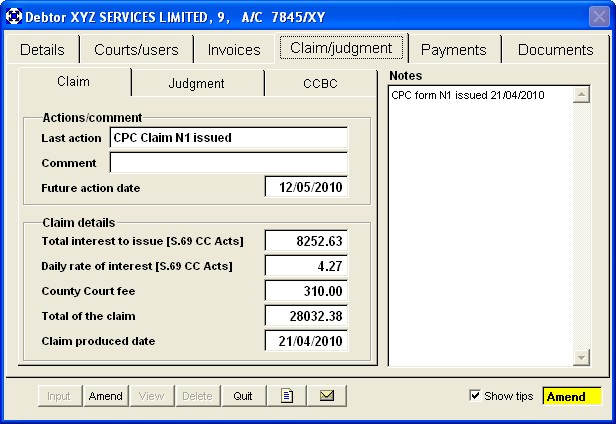

INTEREST

The total of interest charged under S.69 to the date when you raised the claim. The interest is totalled

into "DEBT + INTEREST" on the face of the claim.

A composite daily rate of interest at 8% on all invoices which will be used to add interest up to the

day when judgment is entered. [Shown on the claim re: S.69]

COURT FEE

The court claim fee on the face of the claim. The system calculates this for you automatically.

CLAIM VALUE

The total of debt, interest and the claim issue fee.

CLAIM DATE

The date the claim was PRODUCED and the date appearing on the face of the claim.

The date the Court ISSUES the claim will appear on the form N205A. The DATE OF POSTAL SERVICE is the

reference point for calculating 14 days to judgment by default.

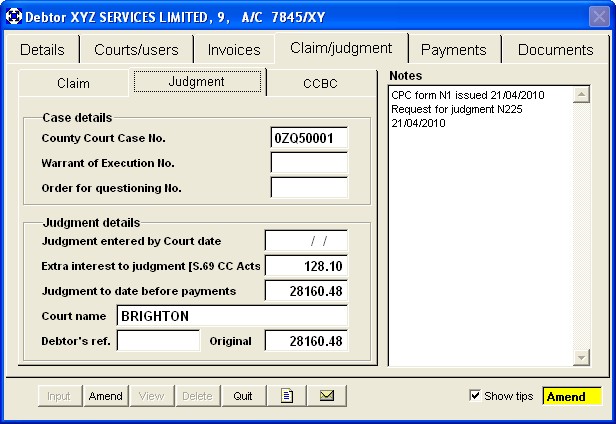

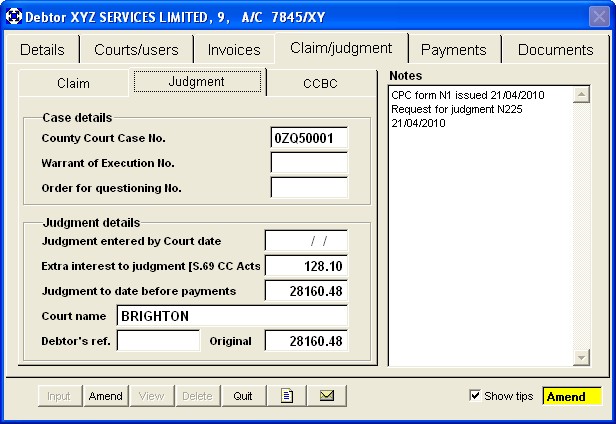

EXTRA INTEREST

The extra interest from the date of the claim to the date when judgment was entered. This total is the

number of days x the daily rate.

CUMULATIVE DEBT

The total of the judgment less any payments received. This total is used for enforcement purposes and

should include the cost of any previous attempt at enforcement.

SHORT COMMENT

Insert any comments or notes as required.

NOTES

Insert notes in this scrollable window.The system inserts events here Example: Claim issued 21/09/2006.

Notes have unlimited capacity.

LAST ACTION

A description of the last action taken. For example: "Claim issued" "Warrant of Execution issued". The system

will place a comment whenever action is taken.

FUTURE ACTION DATE

Insert the date of any important FUTURE event, for example: * Oral examination date

The system automatically inserts a date 7 days ahead of each reminder letter.

DELETIONS

Use the DELETE option to remove debtor records no longer required. Eg. when payment has been made.

CASE NUMBER

Case number given to you by the court. Always quote in correspondence. For example: 6BN04321. If the case

has been transferred to the High Court for enforcement a reference like this will be given: 2006 -W- No.330.

The Claim number will change if the case is transferred to another Court.

WARRANT OF EXECUTION NO.

Insert the Warrant of Execution number when you are notified by the Court.

Quote this when in correspondence with the Court or the Bailiff's office. Example reference: A01680

ORAL EXAMINATION NO.

Insert the Oral Examination number when you are notified by the court.

COUNTY COURT LIST

The system defaults to the user's County Court for proceedings.

The default on screen 2 for the defendant is ABERDARE so click in the scrollable box for their correct

County Court. This can be used later in Legal and Letters.

This screen follows on directly after debtor input. The debtor name and number is inserted automatically and you are permitted to insert 12 lines of debt detail. Where there are more than 12 lines of debt, try to group the invoices into monthly accounts. On a nett monthly account basis all invoices in any given month fall due for payment on the same day. Invoice values should include VAT. Round sum payments which have not been allocated can be input as follows: DATE DESCRIPTION AMOUNT DUE 15/01/2007 Payment (£500.00) 15/01/2007 The date of the payment is deemed to be its due date. Alternatively, deduct the payment(s) off the oldest invoices first. This will probably result in one part paid invoice: DATE DESCRIPTION AMOUNT DUE 15/01/2007 INVOICE 1234 (PART) £401.23 15/02/2007 The due date for payment is important because it is the date used for the calculation of interest at 8% when a claim is issued. See INTEREST Invoices entered in ERROR may be deleted later which will reduce the total due on DEBTOR SCREEN 1.

[Maintenance…Debtor…Input]